57,60 €*

Versandkostenfrei per Post / DHL

Lieferzeit 1-2 Wochen

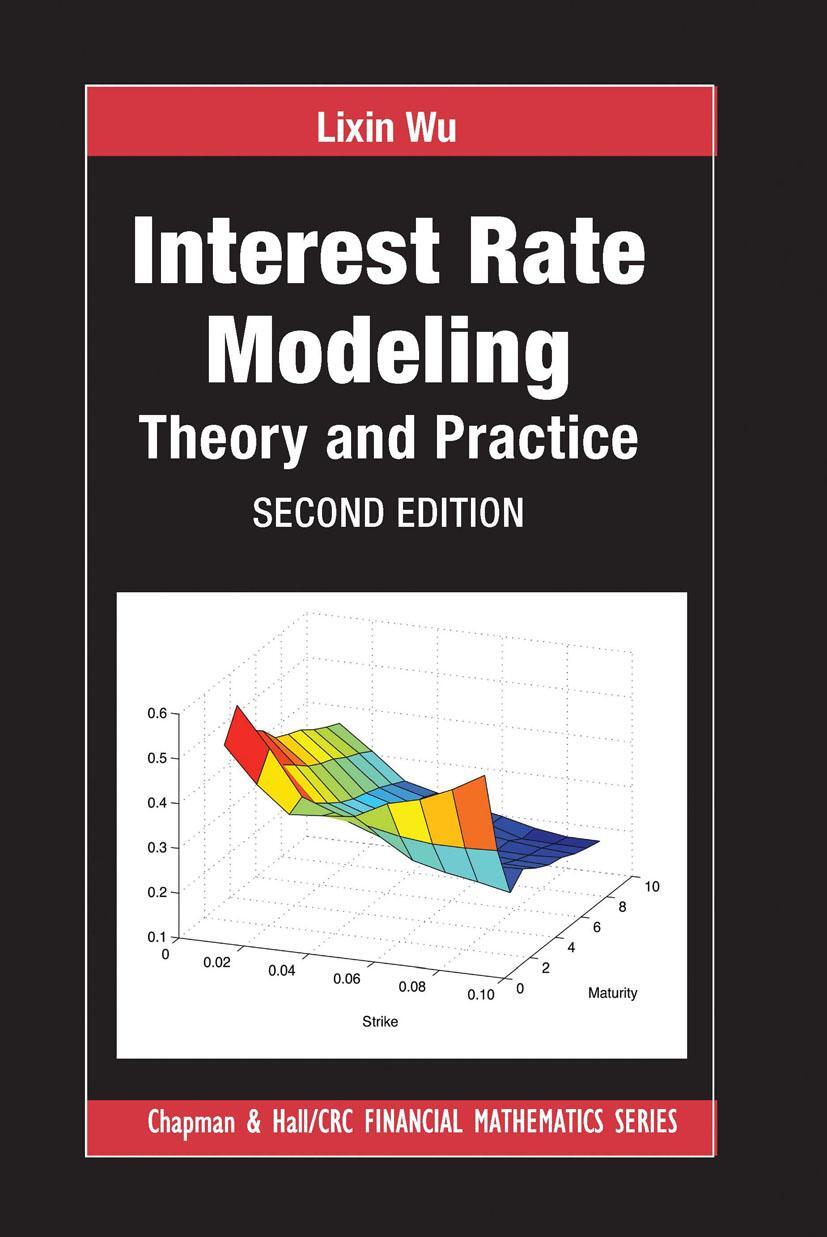

Containing many results that are new or exist only in recent research articles, Interest Rate Modeling: Theory and Practice portrays the theory of interest rate modeling as a three-dimensional object of finance, mathematics, and computation.

Containing many results that are new or exist only in recent research articles, Interest Rate Modeling: Theory and Practice portrays the theory of interest rate modeling as a three-dimensional object of finance, mathematics, and computation.

Lixin Wu is a professor at the Hong Kong University of Science and Technology. Best known in the financial engineering community for his work on market models, Dr. Wu co-developed the PDE model for soft barrier options and the finite-state Markov model for credit contagion.

1. The Basics of Stochastic Calculus

2. The Martingale Representation Theorem

3. Interest Rates and Bonds

4. The Heath-Jarrow-Morton Model

5. Short-Rate Models and Lattice Implementation

6. The LIBOR Market Model

7. Calibration of LIBOR Market Model

8. Volatility and Correlation Adjustments

9. Affine Term Structure Models

10. The Market Model for Inflation-Rate Derivatives.

11. Levy Market Model

12. Market Model for Inflation Derivatives Modeling

13. Market Model for Credit Derivatives

14. Dual-Curve Market Models for Post-Crisis Interest Rate Derivatives Markets

15. xVA Definition, Evaluation and Risk Management

| Erscheinungsjahr: | 2020 |

|---|---|

| Fachbereich: | Allgemeines |

| Genre: | Wirtschaft |

| Rubrik: | Recht & Wirtschaft |

| Medium: | Taschenbuch |

| Seiten: | 494 |

| Inhalt: | Einband - flex.(Paperback) |

| ISBN-13: | 9780367656553 |

| ISBN-10: | 0367656558 |

| Sprache: | Englisch |

| Einband: | Kartoniert / Broschiert |

| Autor: | Wu, Lixin |

| Hersteller: | Taylor & Francis Ltd |

| Maße: | 155 x 233 x 46 mm |

| Von/Mit: | Lixin Wu |

| Erscheinungsdatum: | 30.09.2020 |

| Gewicht: | 0,868 kg |

Lixin Wu is a professor at the Hong Kong University of Science and Technology. Best known in the financial engineering community for his work on market models, Dr. Wu co-developed the PDE model for soft barrier options and the finite-state Markov model for credit contagion.

1. The Basics of Stochastic Calculus

2. The Martingale Representation Theorem

3. Interest Rates and Bonds

4. The Heath-Jarrow-Morton Model

5. Short-Rate Models and Lattice Implementation

6. The LIBOR Market Model

7. Calibration of LIBOR Market Model

8. Volatility and Correlation Adjustments

9. Affine Term Structure Models

10. The Market Model for Inflation-Rate Derivatives.

11. Levy Market Model

12. Market Model for Inflation Derivatives Modeling

13. Market Model for Credit Derivatives

14. Dual-Curve Market Models for Post-Crisis Interest Rate Derivatives Markets

15. xVA Definition, Evaluation and Risk Management

| Erscheinungsjahr: | 2020 |

|---|---|

| Fachbereich: | Allgemeines |

| Genre: | Wirtschaft |

| Rubrik: | Recht & Wirtschaft |

| Medium: | Taschenbuch |

| Seiten: | 494 |

| Inhalt: | Einband - flex.(Paperback) |

| ISBN-13: | 9780367656553 |

| ISBN-10: | 0367656558 |

| Sprache: | Englisch |

| Einband: | Kartoniert / Broschiert |

| Autor: | Wu, Lixin |

| Hersteller: | Taylor & Francis Ltd |

| Maße: | 155 x 233 x 46 mm |

| Von/Mit: | Lixin Wu |

| Erscheinungsdatum: | 30.09.2020 |

| Gewicht: | 0,868 kg |